As of the current information available, Tennessee offers a sales tax holiday for gun safes. This initiative exempts certain gun safes from the state sales tax.

Explore the advantages of Tennessee’s tax incentive for gun owners prioritizing safety and responsible storage. With secure storage laws becoming more stringent, Tennessee’s tax exemption on gun safes is a prudent financial incentive for firearm owners. It shows the state’s commitment to encourage the safekeeping of weapons, potentially reducing accidental injuries and theft.

This policy could tip the balance for those considering a gun safe purchase, offering both a safety solution and a financial benefit. It’s a smart move for gun owners looking to secure their firearms while saving money in Tennessee.

Tennessee’s Approach To Gun Safety

Tennessee treats gun safety as a priority. Bold moves in legislation reflect this commitment. To encourage safe firearm storage, Tennessee once offered a unique financial incentive. A specific focus on gun safes was part of this movement. Let’s explore the historical context and current landscape of this approach.

Historical context of tax-free gun safesHistorical Context Of Tax-free Gun Safes

A pioneering tax break initiative began in Tennessee. This effort aimed to make gun safes more affordable. The state recognized that safe storage could prevent accidents and misuse. Tax exemptions on gun safes were introduced to reduce financial barriers for responsible gun owners.

Current legislation on gun storage in TennesseeCurrent Legislation On Gun Storage In Tennessee

As of now, Tennessee continues to focus on gun safety. There have been changes since the original tax incentives. The state has adapted tax policies over time. Current legislation might be different from the initial introductions. It reflects Tennessee’s ongoing evolution in promoting safe gun storage.

To know the latest on tax exemption status, residents can check with local authorities or tax advisors. Safe storage remains a key aspect of Tennessee’s legislation, aiming to protect communities and promote responsible gun ownership.

Economic Implications For Consumers

Under the subheading ‘Economic Implications for Consumers,’ let’s delve into what tax-free gun safes mean for your wallet. Recognizing these financial effects is crucial. A tax break can make a significant difference. It makes gun safes more affordable for Tennessee residents. This leads to more secure storage of firearms.

Cost Benefits Of Tax Exemptions

Tax exemptions come as a relief for consumers. They render products like gun safes more budget-friendly. These savings can encourage responsible gun ownership. You save money that can go towards other safety measures.

- Reduced Upfront Cost: No tax means lower purchase prices.

- Boost in Sales: Tax breaks often lead to higher demand. Retailers might offer better deals.

- Long-term Savings: Investing in a safe now protects against potential loss, theft, or damage.

Comparing Expenses With And Without Tax Relief

Understanding expense differences with tax relief is essential. It clarifies the actual savings involved. Consider both scenarios to see the clear advantages of tax-free periods.

| Expense Element | With Tax | Without Tax |

|---|---|---|

| Purchase Price | Higher due to added tax | Lower and more attractive |

| Overall Cost | Increases total investment | Decreases upfront spending |

Let’s visualize with numbers. A $500 gun safe, typically subject to a 7% tax, costs you $35 extra. During tax-free events, that charge drops. You pocket that $35 or allocate it elsewhere.

Legal Framework Governing Tax Exemptions

The state of Tennessee offers a range of tax exemptions to its residents. These exemptions exist under a legal framework established to support economic growth and public safety. Understanding this legal structure is essential for taxpayers looking to benefit from tax relief opportunities.

Overview Of Tennessee Tax Laws

Tennessee tax laws are designed to balance the state’s financial needs with the well-being of its citizens. These laws determine which items are taxable and which qualify for tax exemption. Below is a list of important elements in Tennessee tax laws:

- Sales tax regulations vary based on categories of items

- Exemption clauses provide relief on certain goods

- Public safety is a consideration in forming tax policies

How Gun Safes Fit Into Tax Exemption Categories

Gun safes are unique items within Tennessee tax laws. To promote firearm safety, gun safes have historically been offered tax-free. Key points to know include:

| Category | Tax Exemption Status |

|---|---|

| Gun Safes | Eligible for Tax Exemption |

| Firearm Safety Devices | Eligible for Tax Exemption |

These exemptions stand as part of Tennessee’s commitment to responsible gun ownership and the prevention of accidental injuries.

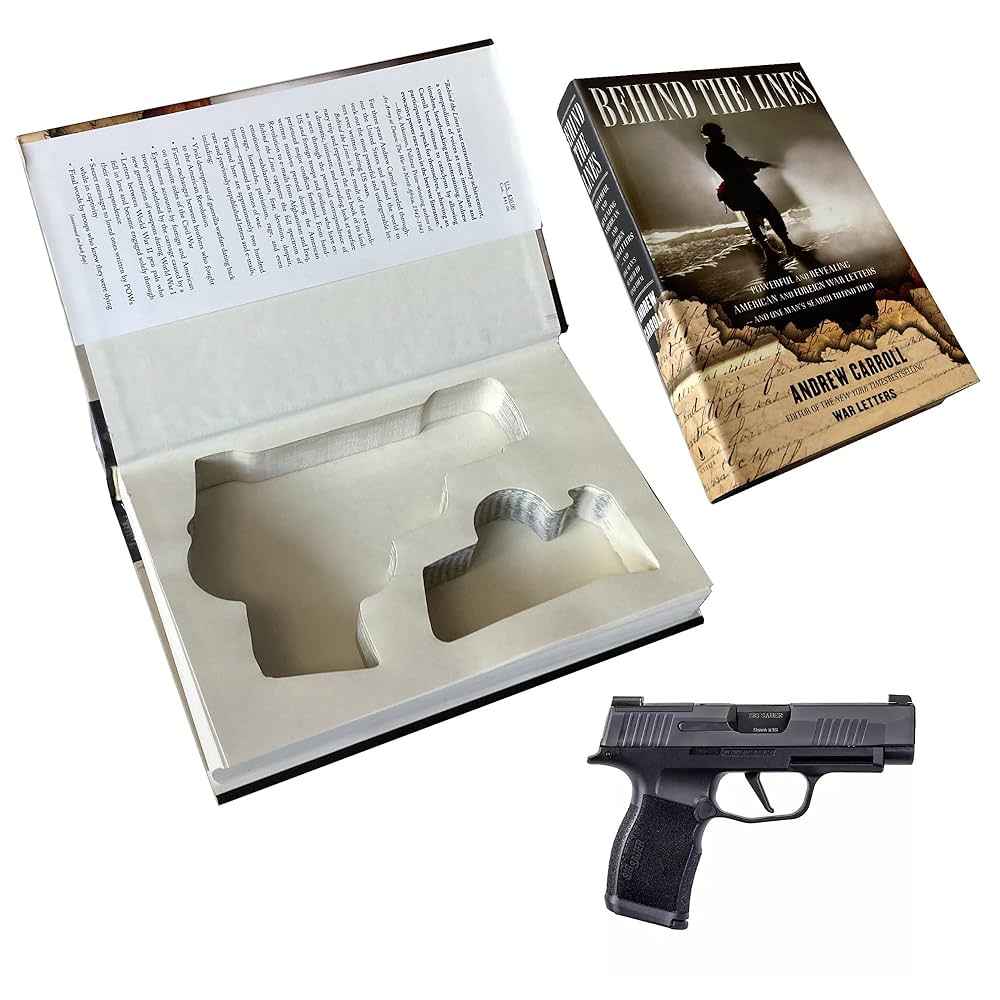

Credit: www.amazon.com

Impact On Public Safety

Tennessee takes pride in responsible gun ownership. A crucial element is the safekeeping of firearms. Is tax exemption on gun safes an effective tool? Let’s explore its influence on safety in the community.

Correlation between safe storage and gun-related incidentsCorrelation Between Safe Storage And Gun-related Incidents

Safe storage can prevent accidents and unauthorized use. Here’s what data shows:

- Reduction in accidental shootings – Properly stored guns are hard to access unintentionally.

- Lower theft rates – A secure safe can deter theft, reducing the number of stolen firearms.

Studies validate how safes link to lower gun mishap rates.

Public policy goals and gun safety incentivesPublic Policy Goals And Gun Safety Incentives

Tennessee’s approach involves promoting gun safety without imposing on rights. The state’s policy objectives aim to:

- Encourage voluntary safe storage practices.

- Offer tax incentives for purchasing gun safes.

- Support public awareness campaigns on firearms safety.

These efforts intend to enhance public safety proactively.

Navigating The Purchase Process

Excitement buzzes around Tennessee’s unique tax benefits for gun safe purchases. Eligible residents can buy gun safes tax-free. Understanding this process is crucial.

Steps To Buying A Tax-free Gun Safe

The journey to owning a tax-free gun safe is straightforward. Follow these steps to ensure a seamless experience.

- Confirm Eligibility: Check the Tennessee Department of Revenue for details on tax-free qualifications.

- Identify Qualifying Safes: Ensure the safe meets the state’s standards for tax exemption.

- Purchase During Tax Holiday: Buy your safe during Tennessee’s designated tax holiday period.

- Keep Receipts: Save all purchase documents. You may need them for future reference.

Common Pitfalls To Avoid In Claiming Tax Exemption

Beware of common mistakes during the tax exemption process. Avoid these errors to guarantee your purchase remains tax-free.

- Ignoring Dates: Buying outside the tax-free dates leads to lost benefits. Mark your calendar.

- Choosing Non-Qualifying Models: Not all safes are eligible. Confirm before you commit.

- Forgetting Documentation: No proof, no exemption. Keep your sales slips.

- Overlooking Fine Print: Read all rules. Small details might disqualify your purchase.

Credit: www.propublica.org

Future Of Gun Safe Tax Policies

Keeping firearms secure is crucial for safety. It’s no wonder that tax incentives on gun safes have become a hot topic. In Tennessee, gun safes have been tax-free. This exemption encourages gun owners to invest in secure storage. Yet, tax policies may change. Let’s explore what the future might hold for these policies.

Potential Changes In Legislation

Lawmakers continuously review tax policies. With each session comes the chance for new rules. Below, we examine possible changes to gun safe tax exemptions.

- Increased Incentives: Legislators might boost tax breaks, making safes more affordable.

- Expiration Dates: Current exemptions could face deadlines, urging faster purchases.

- New Requirements: Future laws may set standards for qualifying safes.

Table 1 summarizes the legislative scenarios.

| Possible Change | Impact on Tax Exemption |

|---|---|

| Increased Incentives | Lower prices through bigger breaks |

| Expiration Dates | Encourages immediate safe purchase |

| New Requirements | Defines eligible safe features |

Ongoing Debates And Public Opinion

Community discussions influence tax policies. Local debates shape future laws. Citizens’ safety concerns and budgetary priorities matter.

- Citizens’ Safety Concerns: More people may support tax-free safes for public safety.

- Budget Priorities: Citizens and lawmakers align on how to spend public funds.

- Feedback Loops: Lawmakers analyze public feedback on policy effectiveness.

Public opinion charts, as seen in Figure 2, display prevailing sentiments.

Expect ongoing changes as legislators react to public views.

Credit: www.wbir.com

Frequently Asked Questions For Are Gun Safes Still Tax Free In Tennessee?

What Is Included In Tax Free Tennessee?

Tax-free items in Tennessee typically include clothing, school supplies, and computers during the annual Sales Tax Holiday. Eligible purchases are exempt from state sales tax.

What Is The Sales Tax On A Gun In Tennessee?

The sales tax on a gun in Tennessee generally combines a 7% state tax with local taxes, which vary by jurisdiction.

Are Gun Safes Exempt From Sales Tax In Texas?

In Texas, gun safes qualify for sales tax exemption under specific circumstances, including the annual Sales Tax Holiday.

What Items Are Subject To Sales Tax In Tennessee?

Tennessee imposes sales tax on tangible personal property and some services. Taxable items include general consumer goods, such as electronics, clothing, and home furnishings, alongside prepared food, some digital content, and certain business transactions.

Conclusion

Navigating the tax landscape in Tennessee regarding gun safes remains straightforward. As of now, residents can still enjoy tax-free purchases, fostering safe firearm storage. Remember, regulations can change, so stay updated. Ensure your investments are protected and in line with current laws for peace of mind and safety.